I'm an AI Structuralist

We're not in a bubble... but the music has stopped.

I’m a firm believer we’re not in a bubble; but I’m not deaf to the music slowing. I’m against the bubble narrative, yet I know danger lurks in the timing. So I asked myself: what term actually captures my stance on all this?

I’m an AI Structuralist.

I see the transformation as real, but I’m not blind to the timing risks everyone’s ignoring.

My Thesis:

AI is the greatest investment theme of our generation

Productivity gains will materially help the US debt problem

This is the largest credit expansion since Pre-WW2

But here’s what the bulls miss: We’re on the left side of the productivity J-curve. Markets are pricing in deflationary productivity gains that won’t hit for years. Meanwhile, the massive capex buildout itself is inflationary. Everyone is short the inflation tail.

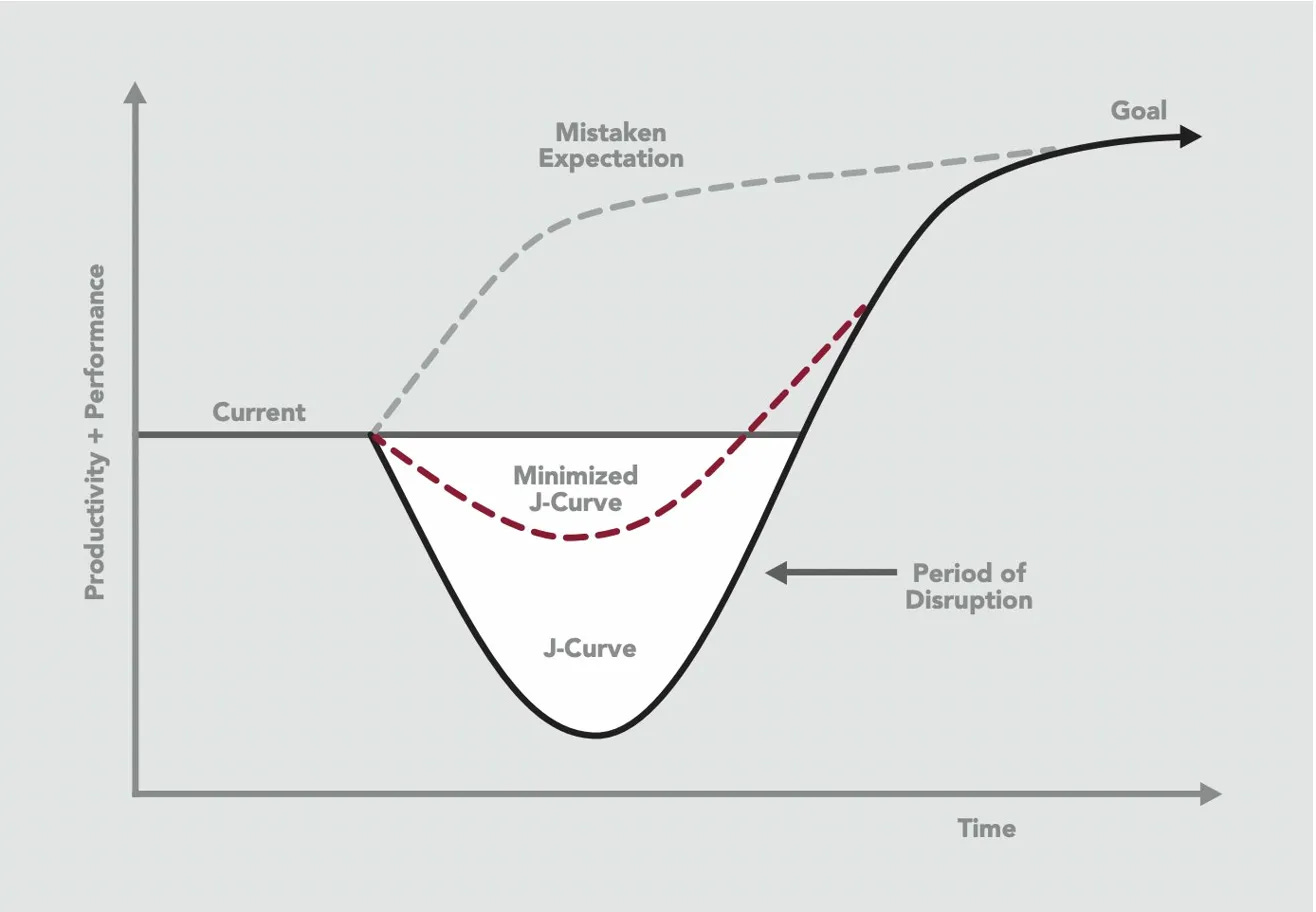

The J-Curve Reality

We’re in the “Period of Disruption”→ productivity actually drops before it explodes. The dashed line shows what markets are pricing (immediate gains). The solid line shows reality (pain before payoff). Most investors are positioning for the fantasy, not the path.

Why This Isn’t Dot-Com

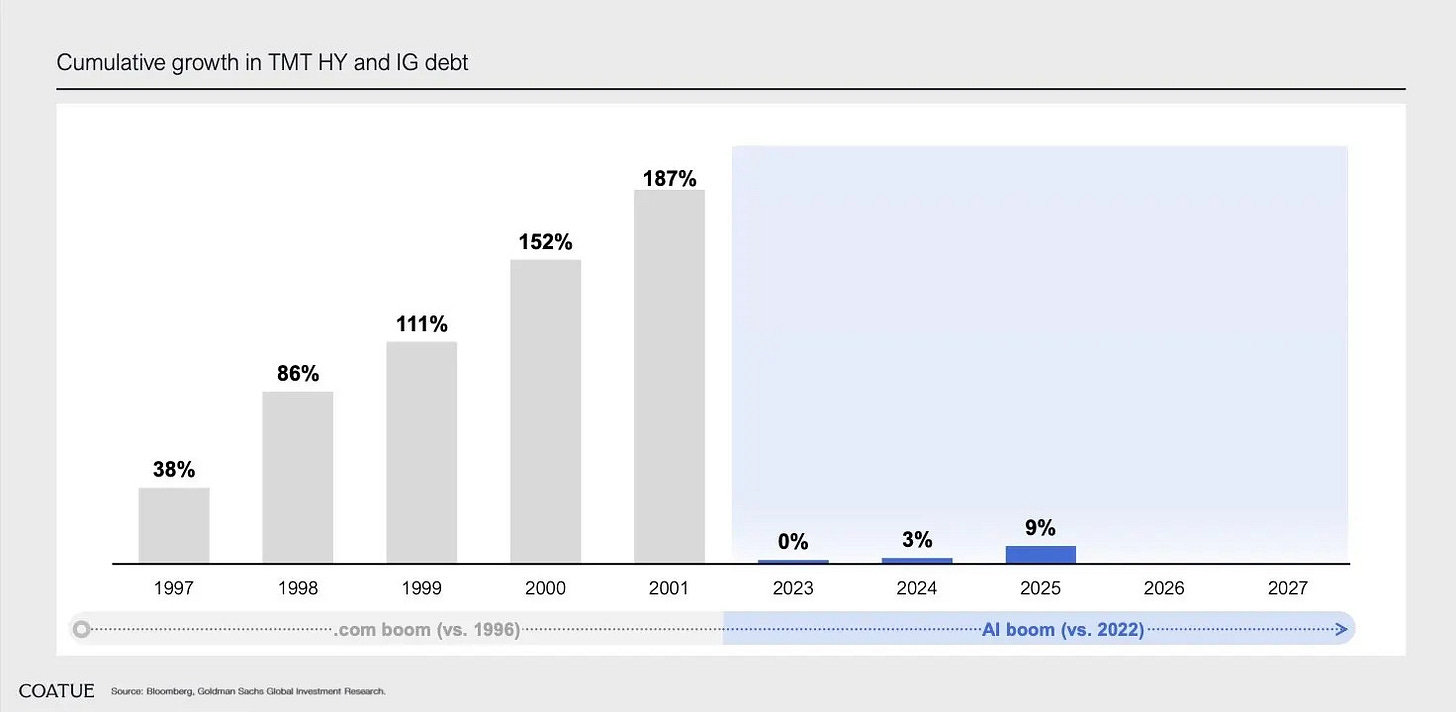

The dot-com bubble was funded by investment-grade debt and vaporware business models. Today’s AI boom is backed by fortress balance sheets and real capital formation → this is infrastructure buildout, not speculation.

During the dot-com era, high-yield and investment-grade debt exploded—cumulative growth hit 187% by 2001. The AI boom? We're at 9% cumulative debt growth since 2022. This isn't leverage-driven speculation. It's equity-funded infrastructure.

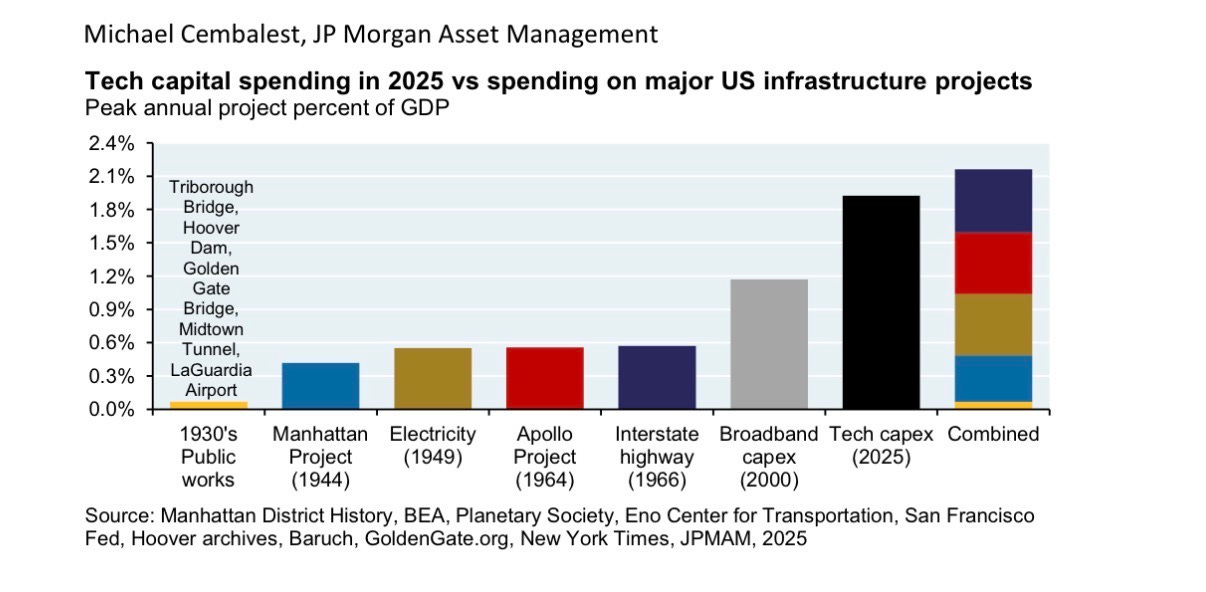

Tech CapEx in 2025 is running at 2.1% of GDP—larger than the Manhattan Project, the Interstate Highway System, and the Apollo Program combined! This is the scale of economic transformation we're witnessing. Not dot-com euphoria. Actual nation-building through compute.

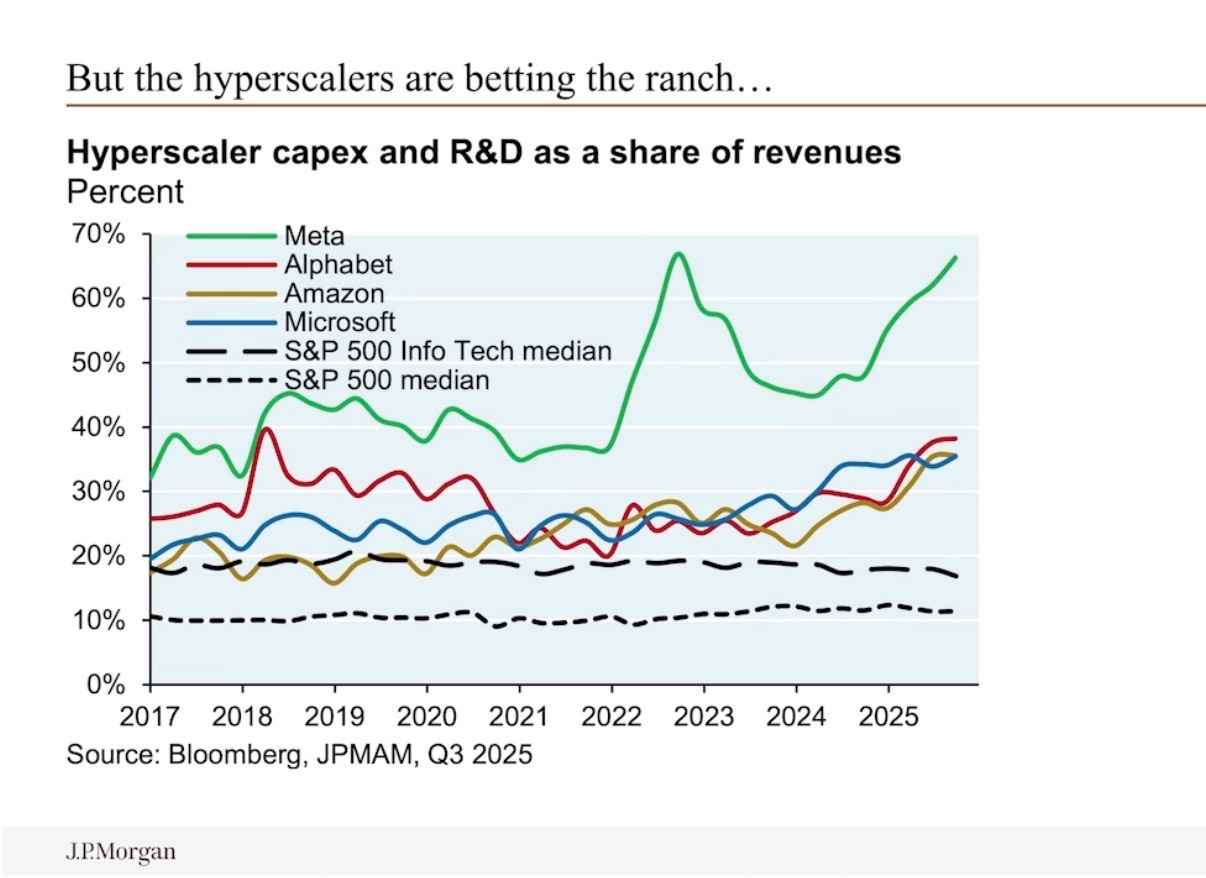

But here's the structuralist reality: Meta META 0.00%↑ is spending 66% of revenues on CapEx and R&D. Microsoft MSFT 0.00%↑, Amazon AMZN 0.00%↑, and Alphabet GOOG 0.00%↑ are all pushing 35%+. These aren't sustainable ratios without consequences.

The trade-off is coming. If we're as early as I believe, these CapEx-heavy companies will likely need to shed headcount to fund their infrastructure projections. That's not weakness → it's the trade-off between building the future and managing quarterly optics. Strong balance sheets buy them that choice. Dot-com companies didn't have it.

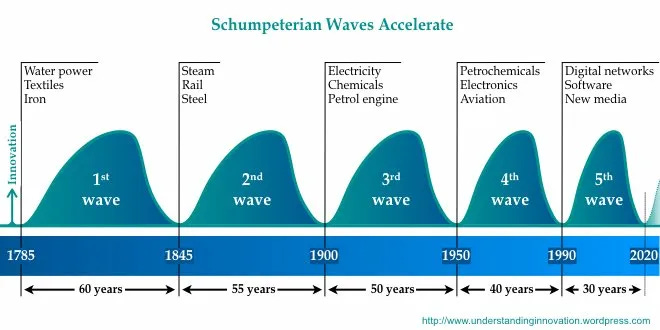

This is a Schumpeterian Moment

We’re witnessing the 5th great wave of creative destruction. Each prior wave (water power, steam, electricity, petrochemicals, digital networks) took 40-60 years to fully mature and generated the largest credit expansions of their eras. Notice the pattern: waves are accelerating—from 60 years down to 30 years between cycles.

AI isn’t following the digital wave playbook. It’s compressing it. The build-out phase is more capital-intensive and faster than anything in history. This creates a unique dynamic: deflationary endgame, inflationary path.

But we're still in the early innings!

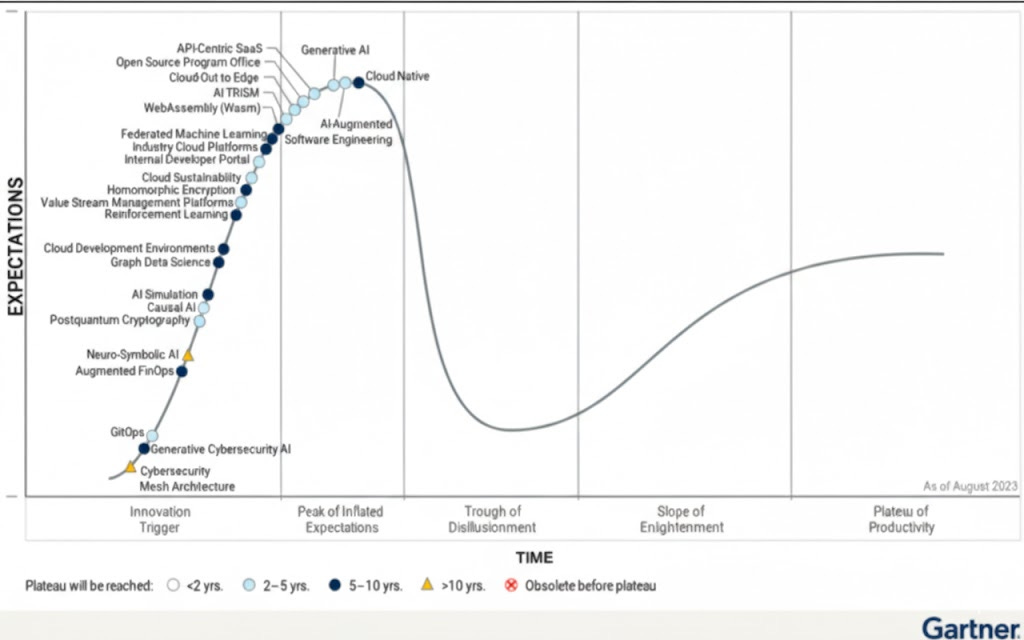

Generative AI just hit the “Peak of Inflated Expectations” in August 2023. According to Gartner, we’re 2-5 years away from the Trough of Disillusionment → the point where reality checks meet hype. This is the J-curve descent. The productivity gains won’t materialize for another 5-10 years, yet markets are pricing them in now.

Most AI infrastructure technologies (Cloud Native, AI-Augmented Software Engineering, Federated Machine Learning) are still 5-10 years from plateau. We’re building the rails before the trains arrive. That’s not a bubble. That’s the cost of being structurally early.

My Personal Stance: Secular Bull, Cyclical Caution

I’m structurally long the multi-decade trend. But I’m hedging the path—because the route to productivity paradise runs through an inflationary gauntlet that nobody’s positioned for.

Not a bubble. A repricing of the cost of capital for a new productivity regime.

The Term: AI Structuralist with Inflation Hedges